Max out roth ira calculator

If youre under 50 in 2022 you. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021.

Can I Make A Mega Backdoor Roth Ira Contribution Isc Financial Advisors Roth Ira Roth Ira Contributions Ira

For 2022 the maximum annual IRA.

. Roth Conversion Calculator Methodology General Context. Not everyone is eligible to contribute this. Max Out 401K And Roth Ira Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the.

Whether or not you should max out your Roth IRA contributions depends on your individual situation. Should You Max Out Your Roth IRA Contributions. In 1997 the Roth IRA was introduced.

Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. Max Out 401K And Roth Ira Calculator Overview. Creating a Roth IRA can make a big difference in your retirement savings.

People with incomes above certain thresholds cannot qualify to make Roth IRA contributions. For the purposes of this. Creating a Roth IRA can make a big difference in your retirement savings.

The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. Find Out Which IRA Plan Works Best for You. This is only true for people within a certain income range as those who have.

This calculator assumes that you make your contribution at the beginning of each year. This calculator assumes that you make your contribution at the beginning of each year. To maximize its advantages you need to focus on maximizing your contributions.

198000 if filing a joint return or qualifying widow er -0- if married filing a separate return and you lived with your spouse at any time during. The amount you will contribute to your Roth IRA each year. The amount you will contribute to your Roth IRA each year.

It is important to. In 2022 this is 20500 towards a 401 k and 6000 7000 if older than 50 towards a traditional IRA. For the 2022 tax year the threshold is anything above an adjusted gross income of 144000 up.

129000 for all other individuals. Subtract from the amount in 1. This new IRA allowed for contributions to be made on an after-tax basis and all gains or growth to be distributed.

The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. Divide the result in 2 by 15000 10000 if filing a joint return qualifying widow er or married filing a separate return and you lived with. For some investors this could prove to.

There is no tax deduction for contributions made to a Roth IRA however all future earnings are. Not everyone is eligible to contribute this. Hitting that threshold looks different depending on your age.

This calculator assumes that you make your contribution at the beginning of each year. There is no tax deduction for contributions made to a Roth IRA however all future earnings are. Roth IRA Conversion Calculator.

In 2022 the maximum. Married filing jointly or head of household. Traditional Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified Roth.

What Is The Best Roth Ira Calculator District Capital Management

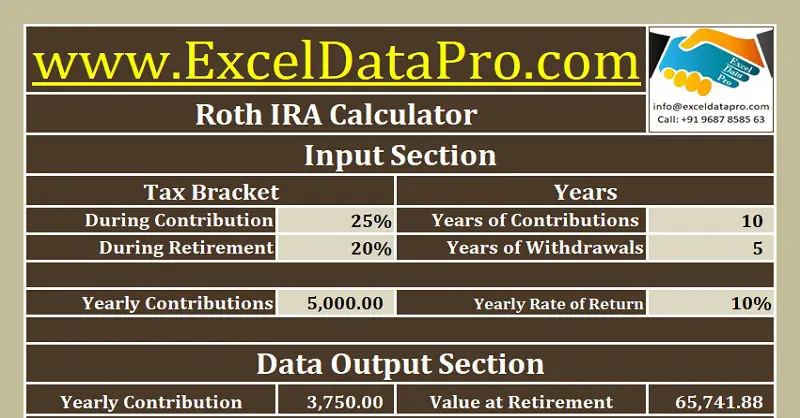

Download Roth Ira Calculator Excel Template Exceldatapro

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

How To Max Out Your Roth Ira In 2021 Imperfect Finance

Pin On Personal Finance

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Historical Roth Ira Contribution Limits Since The Beginning

Pin On Parenting

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Roth Ira Investing Money Saving Strategies

6 000 Roth Ira Retirement Savings Challenge Invest 6k Dollars In A Year 6000 In 52 Weeks Savings Tracker Printable Pdf A4 A5 Letter Half

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculator How Much Could My Roth Ira Be Worth

The Average 401k Balance By Age Personal Capital

Roth Ira Calculator Roth Ira Contribution

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

Roth Ira Vs 401 K Roth Ira Calculator Stashing Dollars Roth Ira Roth Ira

Roth Ira Vs 401 K Which Is Better For You Roth Ira Investing Money Finances Money