Futa tax calculator

We wont go into all the nitty-gritty details here. This tool allows.

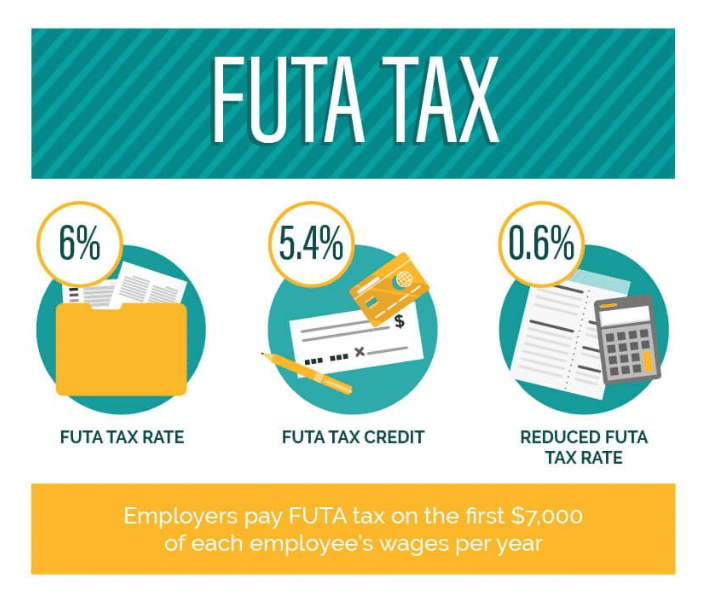

What Is The Federal Unemployment Tax Rate In 2020

The tax that only employers must pay is federal unemployment tax FUTA.

. Calculate adjustments for state unemployment tax payments. The business stops paying SUTA tax on Barrys wages once he makes 7000 which happens in the middle of Q2. Calculate the FUTA Unemployment Tax which is 6 of the first 7000 of each employees taxable income.

Paycheck City is a free online withholding calculator. For the 2022 tax filing season individuals must file their tax returns by April 18. How much you withhold here depends on the employees withholding selections on their Form W-4 The amount each employee withholds varies based on their earnings filing status and other factors.

This is a list of all state unemployment agencies. Department of Labor Frances Perkins Building 200 Constitution Ave NW Washington DC 20210 wwwdoletagov Telephone. Youll need to know the total payments for all employees for the year adjust for payments that are exempt from FUTA and subtract payments in excess of 7000.

Some states require employers to pay out accrued unused vacation days with the final paycheck. If you cant meet this years deadline youll need to file an extension. Premium Only Plan POP A POP allows you and your employees to pay insurance premiums with pre-tax dollars.

Power of Attorney Form. The two taxes that only employees pay are. Determine your FUTA tax for the year considering any adjustments to gross pay to employees that are exempt from FUTA tax.

The chart below does not include these vacation. Deduct and match any FICA taxes. Tax credits directly reduce the amount of tax you owe dollar for dollar.

Generally April 15 is the deadline for most people to file their individual income tax returns and pay any tax owed. A tax credit valued at 1000 for instance lowers your tax bill by 1000. You can find all the information you need from the IRS Publication 15-T.

If you get the full credit your net FUTA tax rate would be just 06 42 plus whatever you owe to your state government. Most states require employers to give departing employees their final paychecks in fairly short order -- sometimes on their last day of work. Review IRS Tax Topic on notices and bills penalties and interest charges.

Two common types of section 125 plans are. Federal Income TaxThe biggest tax of them all which can range from 0 all the way to 37. When processing is complete if you owe any tax penalty or interest.

The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000. Together with group health insurance a POP reduces taxable income and results in a reduction in the amount used to determine your companys FICA Federal Insurance Contributions Act and FUTA Federal. Use this payroll tax calculator to see how adding new employees will affect your payroll taxes.

Employment and Training Administration US. In some states these time limits vary depending on whether the employee quit or was fired. Employee 3 has 37100 in eligible FUTA wages but FUTA applies only to the first 7000 of each.

Why Gusto Payroll and more Payroll. FUTA Unemployment TaxesYour employees sit this one out. Reimbursing Employer Trust Fund.

Note that if you pay state unemployment taxes in full and on time you are eligible for a tax credit of up to 54 which brings your effective FUTA tax rate to 06. Automatic deductions and filings direct deposits W-2s and 1099s. Both reduce your tax bill but in different ways.

However they cant exclude this income from FICA tax and must pay the entire self-employment tax. Meanwhile maximum tax rates can be as high as 12 percent as is the case in Wisconsin. Penalty and Interest Information.

The following links provide additional information regarding Unemployment Insurance Tax requirements for employers. As Barrys employer you remit 150 of SUTA taxes at the end of March and 60 at. Employer Electronic File Format.

If an employer has questions regarding the SUTA it would be wise to inquire with the proper agency. This rate and the annual wage limit is determined for you by your state unemployment agency. Kentucky Career Center Informational Videos.

The extended deadline for 2022 is. Some state unemployment tax rate minimums are as low as 00 as is the case in places like Hawaii Iowa Mississippi Missouri Montana Nebraska and South Dakota. During its processing the IRS checks your tax return for mathematical accuracy.

Only employers are responsible for paying the FUTA tax.

Formulate If Statement To Calculate Futa Wages Microsoft Community

Medicare Tax Calculation How To Calculate Medicare Payroll Taxes Youtube

What Is Futa Tax It Business Mind

How To Calculate Unemployment Tax Futa Dummies

The Top How To Calculate Federal Unemployment Tax

Calculating Employer Payroll Taxes Youtube

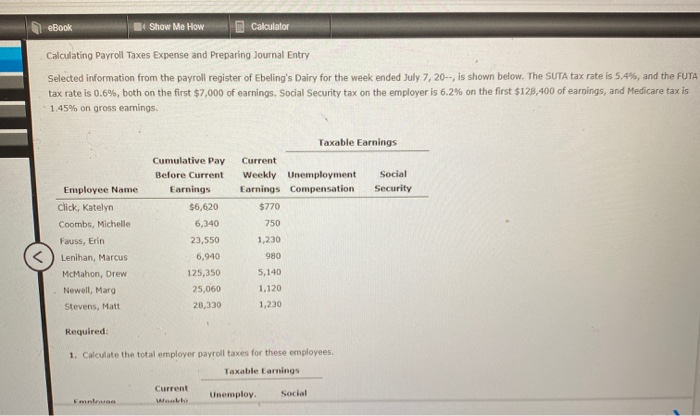

Solved Ebook Show Me How Calculator Calculating Payroll Chegg Com

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax Calculator For Employers Gusto

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Calculating Futa And Suta Youtube

The Futa Tax Rates For California Increase For 2016

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Futa Tax Overview How It Works How To Calculate

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

What Is Futa Tax 2021 Tax Rates And Information